Get the security of PCI DSS certification without the hassle.

Strike Graph ensures your cardholder data is protected against theft and fraud and sets you up for broader cybersecurity success.

Don’t risk a data breach — and penalties.

When time and resources are thin, requirements like PCI DSS can fall through the cracks, leaving your customer data unprotected. When a data breach happens (and it will), customers lose trust, and your company may be fined penalties as high as $500,000 per incident.

Traditional PCI DSS assessments

Manually completing the PCI DSS Self-Assessment Questionnaire (SAQ) every single year can leave you feeling like it’s groundhog day.

Strike Graph

You complete a risk assessment in the Strike Graph platform once, and we leverage it for future PCI DSS assessments and other cybersecurity certifications.

Why PCI DSS matters.

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to ensure all companies that accept, process, store, or transmit credit card information maintain a secure environment. Compliance is mandatory for any business handling credit card transactions, safeguarding against data breaches and fraud. PCI DSS compliance demonstrates a company's commitment to secure payment processing, essential for customer trust and legal adherence.

-min.png?width=2000&height=900&name=Rectangle_20451_20(1)-min.png)

Strike Graph makes PCI DSS certification easier each year.

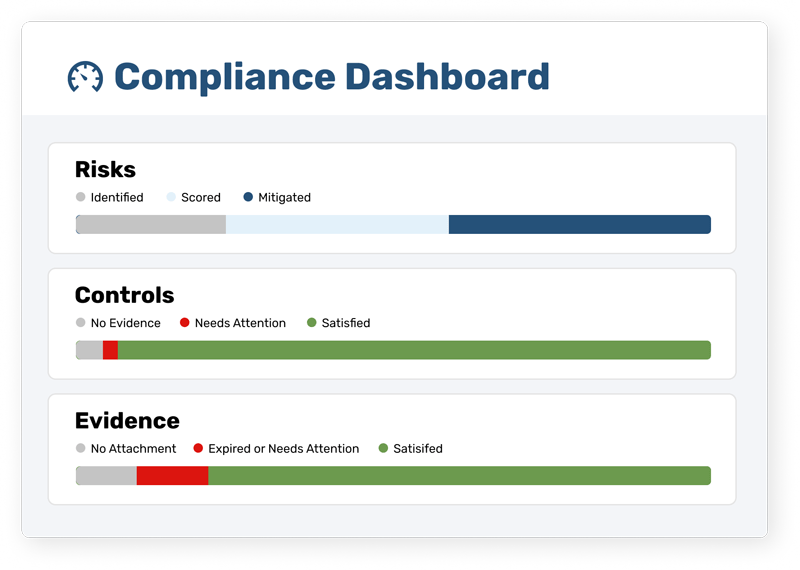

No more guesswork

Tired of trying to decipher a mysterious questionnaire? Our PCI DSS gap assessment lets you know exactly which actions your company needs to take to get and remain in PCI DSS compliance.

Everything you need in one place

From connecting you with a PCI Approved Scanning Vendor to arranging for a full audit, Strike Graph does the PCI DSS certification legwork so you can focus on growing your business.

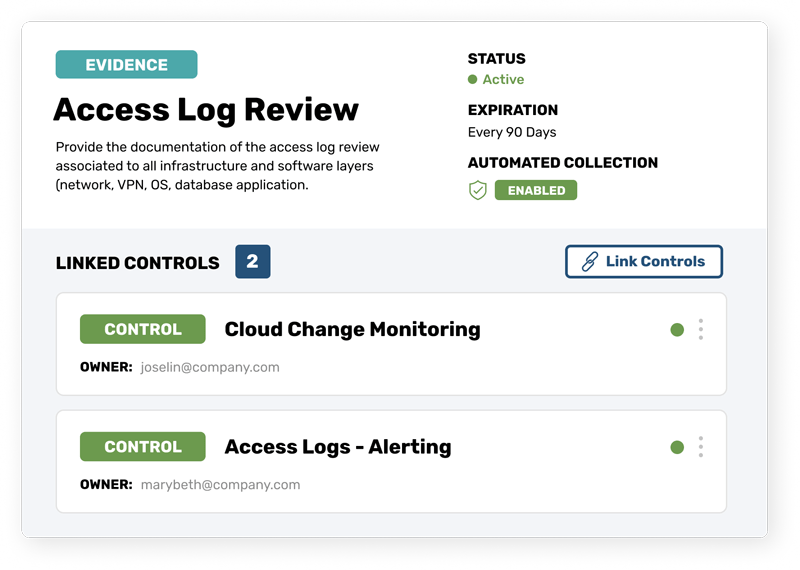

Smarter, not harder

As your business grows, your cybersecurity needs will grow with it. Strike Graph allows you to enter controls and evidence once and then use them for multiple certifications, saving time and money.

Packed with

useful features

penetration testing

questionnaire tool

Identify your existing PCI DSS cybersecurity controls with our risk assessment tool.

Strike Graph provides a gap assessment.

If needed, we’ll arrange an audit.

Get your PCI DSS certification.

Hear what our customers think of Strike Graph.

Strike Graph has quickly become core to our compliance efforts

We are a rapidly growing startup and we needed a way to simplify and keep track of our compliance efforts as we work our way from annual HIPAA reviews to SOC 2 and beyond. The platform helps ensure we are not wasting time or duplicating efforts and the Strike Graph team has been an excellent compliment for us as we are evolving. Read more on G2.com

Executive Sponsor, Information Technology and Services

Strike Graph has a solid modern approach streamlining the compliance process

The pre-existing libraries to choose from are beneficial, as well as the ability to add our unique controls is highly efficient and user-friendly. … Strike Graph is an intuitive easy to use tool for efficiently working through the compliance process. Read more on G2.com

— User in computer software

Painless experience

The StrikeGraph platform is effective and easy to use. The policy templates are very helpful as starting points. Read more on G2.com

— User in outsourcing/offshoring

Strike Graph is trusted by hundreds of companies for PCI DSS compliance.

Dig into the details.

Everything you need to know about the PCI DSS compliance and certification process

What is PCI DSS?

PCI DSS stands for the Payment Card Industry Data Security Standard. This information security standard was created to secure credit card and debit card transactions against fraud and data theft by increasing cardholder data controls.

The PCI DSS is administered by the Payment Card Industry Security Standards Council.

Who needs to comply with PCI DSS?

If you are a merchant who accepts or processes payment cards, you must comply with PCI DSS. That’s because this standard applies to all entities that store, process, and/or transmit cardholder data. PCI DSS also applies for technical and operational system components included in or connected to cardholder data.

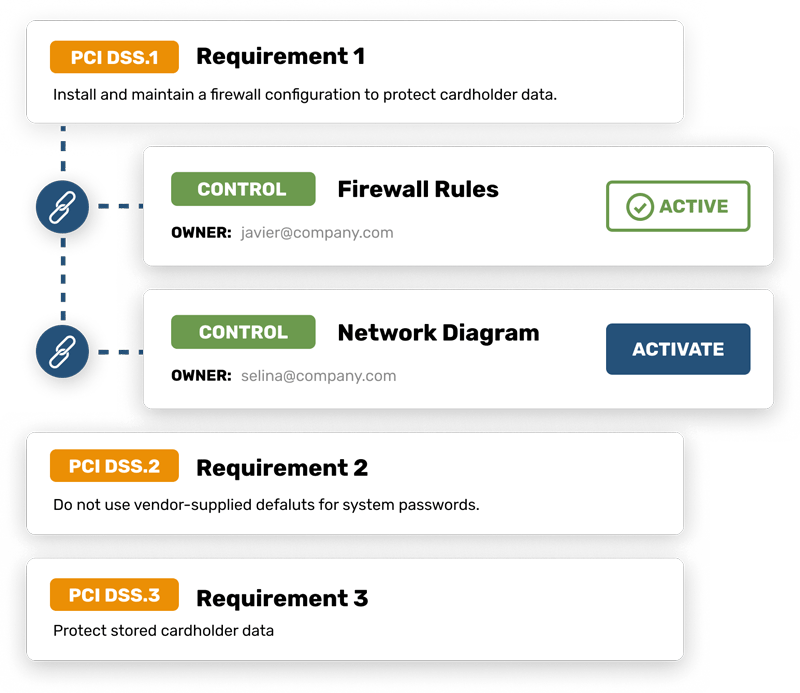

What are the PCI DSS requirements?

All companies that accept or process debit or credit card transactions must meet 12 requirements for handling cardholder data and maintaining a secure network as outlined by the PCI Security Standards Council (PCI SSC):

|

Build and maintain a secure network |

1. Install and maintain a firewall configuration to protect cardholder data |

|

2. Do not use vendor-supplied defaults for system passwords and other security parameters |

|

|

Protect cardholder data |

3. Protect stored cardholder data |

|

4. Encrypt transmission of cardholder data across open, public networks |

|

|

Maintain a vulnerability management program |

5. Use and regularly update anti-virus software or programs |

|

6. Develop and maintain secure systems and applications |

|

|

Implement strong access control measures |

7. Restrict access to cardholder data by business need-to-know |

|

8. Assign a unique ID to each person with computer access |

|

|

9. Restrict physical access to cardholder data |

|

|

Regularly monitor and test networks |

10. Track and monitor all access to network resources and cardholder data |

|

11. Regularly test security systems and processes |

|

|

Maintain an information security policy |

12. Maintain a policy that addresses information security for employees and contractors |

|

Source: https://www.pcisecuritystandards.org/pci_security/maintaining_payment_security |

|

How do I get PCI DSS certification?

How a company verifies that they are complying with PCI DSS requirements varies based on the number of credit or debit card transactions the company processes annually. Companies are split into four levels based on their transaction volume:

Level 1: More than 6 million real-world credit or debit card transactions annually.

Level 2: Between 1 and 6 million real-world credit or debit card transactions annually.

Level 3: Between 20,000 and 1 million e-commerce transactions annually.

Level 4: Fewer than 20,000 e-commerce transactions annually.

Level 1 organizations must undergo an annual internal audit conducted by a Qualified Security Assessor (QSA) and submit to a PCI scan by an Approved Scanning Vendor (ASV) quarterly.

Levels 2, 3, and 4 organizations are only required to complete an annual assessment using a Self-Assessment Questionnaire (SAQ) but may also require a quarterly PCI scan.

Can’t find the answer you’re looking for? Contact our team!

Additional PCI DSS resources

Check out more helpful guides from the Strike Graph team!

Additional PCI DSS resources

Check out more helpful guides from the Strike Graph team!

Still have questions? Let us show you around!

Schedule a demo and one of our experts will show you exactly how our PCI DSS certification process works.

.jpg?width=1448&height=726&name=Screen%20Shot%202023-02-09%20at%202.57.5-min%20(1).jpg)